Chatbots have started making the rounds, especially within the banking system, and have become the most significant development trend today. Chatbots play essential roles in businesses where automation is the need of the hour and manage innovative communications on behalf of the bank.

Customer expectations for digital banking services have increased as the need has risen and new technologies have emerged to meet those needs, such as artificial intelligence. Banks increasingly specialize in assisting clients with personal financial wellbeing. They’re becoming more imaginative and adopting new technology to satisfy client needs.

Banking chatbots are one of the AI-powered tools that banks are increasingly using. Chatbots in the banking industry employ AI and machine learning techniques to enable conversational functionalities and interfaces. They allow users to communicate with them as if the bot were another human to answer any questions. The primary purpose of chatbots in banking is to provide a better customer experience.

Here are the good use cases of chatbots in the banking industry:

Send Timely Alerts & Notifications

Chatbots are often configured to send valuable reminders and regular alerts, like bill payment deadlines or the delivery of specific documents for financial transactions. They will also send important notifications, like banking updates and credit score changes. These push alerts and knowledge may make users conscious of things they didn’t know, leading to increased digital banking service usage and enhanced customer satisfaction.

Make Secure Payments

Chatbots allow users to form quick, hassle-free payments in a few seconds with top-notch security and data protection. Conversational banking chatbots simplify the payment procedure and make it swift, safe, and secure.

Sending Money

Users may use Banking bots to pay their bills, track money transfers, and find out or cancel payments. Users also can use chatbots to charge their prepaid cards or pay off their MasterCard bills.

Addressing Urgent Issues

With the assistance of chatbots in banking, users can get solutions to tasks like locking or unlocking cards, resetting passwords, or checking bank statements. The users get to avoid the hassles of waiting on obtaining answers as bots enable them to urge instant responses to non-complex tasks.

Provide financial insights

Apart from providing updates on withdrawal and deposit, as mentioned above, banking assistants can provide consumers with valuable insights and charges on a selected month or with a specific merchant. One of the fascinating use cases of chatbots for financial institutions is that financial advisors like chatbots collect and analyze data to assist people who have difficulty accessing such services thanks to their budget or location.

Track Transactional History

Users may ask chatbots to summarize their transactions, and a recurrent weekly or monthly report on expenditure, which can help them better manage their money. Chatbots can deliver quick alerts when a payment, withdrawal, or reimbursement occurs within the account.

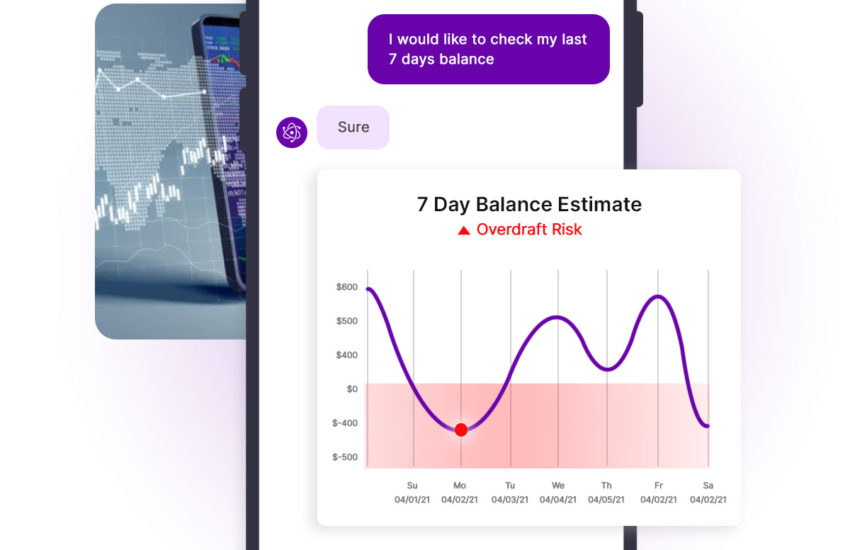

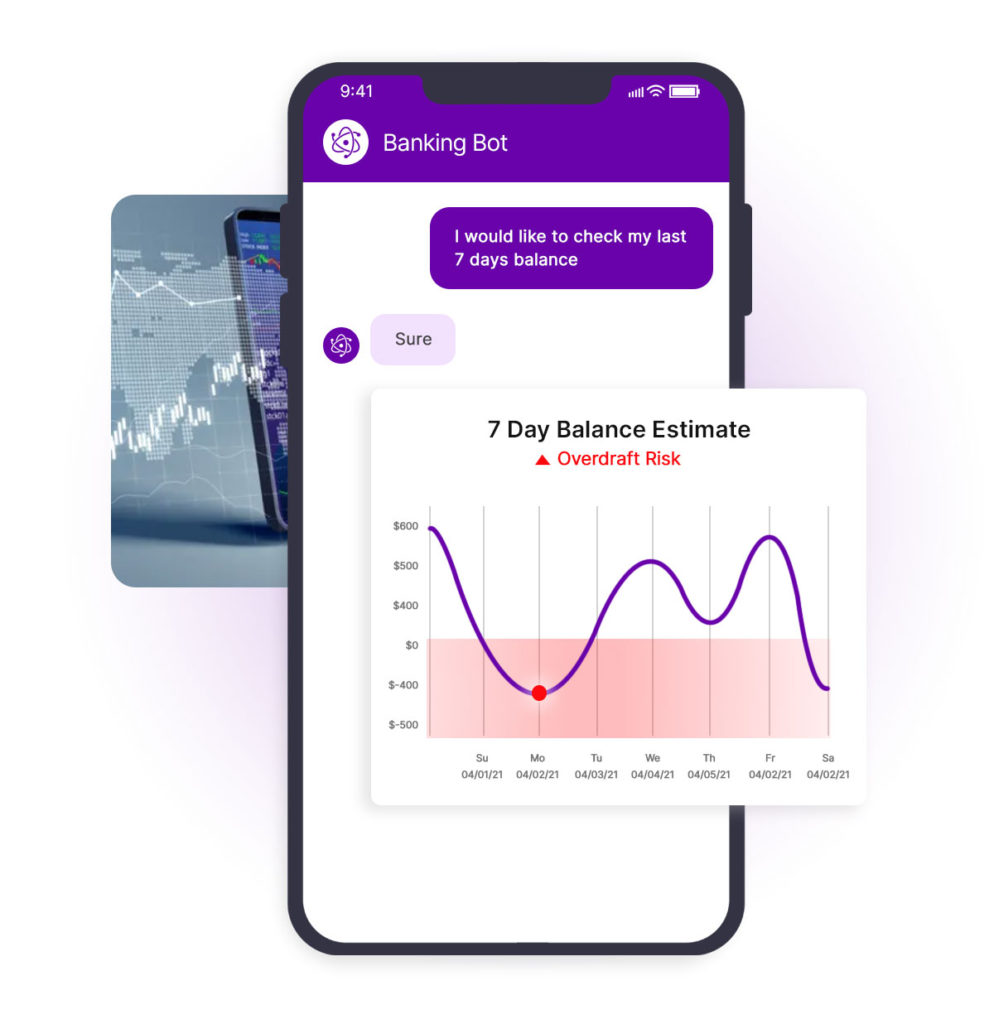

Get Account Balance

Customers can ask chatbots to see their account balance within a couple of seconds. AI assistants also can estimate proportions and warn users if their accounts are close to falling below a particular threshold. This enables customers to manage their accounts without logging into their e-banking account or calling their bank directly.

Conclusion

AppsAI allows banking providers to deliver next-generation financial experiences to their customers. Banks are quickly incorporating chatbots into their operations to improve efficiency. When it comes to adapting AI-powered bots and voice bots, our robust platform has helped banks engage and delight users at every stage of their lifecycle.

To know more about Banking Chatbots, get in touch today!