Customer expectations are rising and can’t be ignored anymore, especially for the banking sector. In banking, chatbots hold great potential to enhance the existing customer experience by allowing customers to check their account balances, effortlessly transfer money, check interest rates, update their billing addresses, and so much more.

On the whole, we can say that customer engagement is crucial for every business. But, with other industries readily adapting AI Chatbots, the banking sector should be no stranger to emerging technologies like Artificial Intelligence and Machine Learning. Using Banking Bots, the service offering that banks can offer to their customers is one that’s personalized, meaningful, and engaging. It gives customers round-the-clock access to banking support. Banks can make great use of Artificial Intelligence and improve customer engagement to reinforce the experience and improve retention.

Customer expectations within the banking system have continually evolved within the last 20 years. Previously, people walked into a branch to get their banking needs met. With the arrival of the web, banks created digital self-service channels via internet banking. With the smartphone boom, there became a requirement to bring banking to mobile.

Banking chatbots are emerging because of the preferred customer support platform. It’s useful for financial service providers because they facilitate two way communication where the AI bot interacts with the existing system to extract information and at the same time share the details with the customer waiting on the other end.

Chatbots in banking increases customer retention

Chatbots within the banking system can help make everyday banking tasks easier. A chatbot isn’t a person that carries a grievance. Bots offer the same experience throughout the customer journey. And, the great part is, the chatbot can do an honest analysis of your customer sessions, read your likes and preferences, and proffer the proper products and services. Chatbots are often useful to spread word of mouth to customers.

Enhanced employee productivity

Chatbots provide a number of serious benefits to employees that help increase work productivity and save their time. Some of the activities include personal details assessment, live application, contact info update, performing an in-depth review of customer engagement patterns, and far more. This aids in increased employee productivity during work hours as employees get to concentrate on the critical issues.

Clear Customer Feedback

Customer feedback is one of the foremost important elements of any banking service. Bots engage customers effectively and get precise feedback that is valuable to the organization. This further helps businesses improve their services. The staff can gain information about the shortcomings and therefore the management offers helpful solutions. This further improves the customer experience and increases efficiency. This means that bots are favorable for workers, management, and customers as all of them are in a far better position at work.

Personalized Marketing Experience for Customers

As banks seek to supply a plethora of services, not every service can have the right taker for it. To offer personalized services to customers, banks can accomplish their particular goals by deploying bots. The delivery of customized services can improve the general rates of conversion by 25%.

Increases Brand Loyalty

Chatbots also can create personalized brand experiences that increase acquisition, conversion, retention, and loyalty. Artificial Intelligence chatbots drive innovation in a controlled manner. They build brand loyalty by engaging with customers on the channels they like, slowly finding an area within the customer’s lifestyle. So to put brand loyalty back to banking and to counter these queries and concerns, many firms have adopted banking chatbots.

Personal Banking

Banks are choosing chatbots to make a customized banking experience. Customers get faster and personalized services that save an excellent amount of your time for both parties. Now chatbots can effectively provide the specified account statements to the customers. Banking Chatbots provide information that’s associated with the newest bank schemes, KYC, and resolve customer issues. The simplest part is that customers don’t need to wait for someone to attend to their queries. As banking bots are already trained to effortlessly answer these queries and concerns.

24/7 Fraud Detection

Be it data security or additional assistance related to fraudulent activities, Chatbots helps financial service providers of all sizes with 24/7 fraud detection. A chatbot sends you an intelligent bot alert to provide you with a warning of suspect transactions. These automated programmed notifications keep you always updated about transactions done on your account in real-time. If it’s a fraud, you’ll also get messages with pre-customized instructions to prevent the transactions.

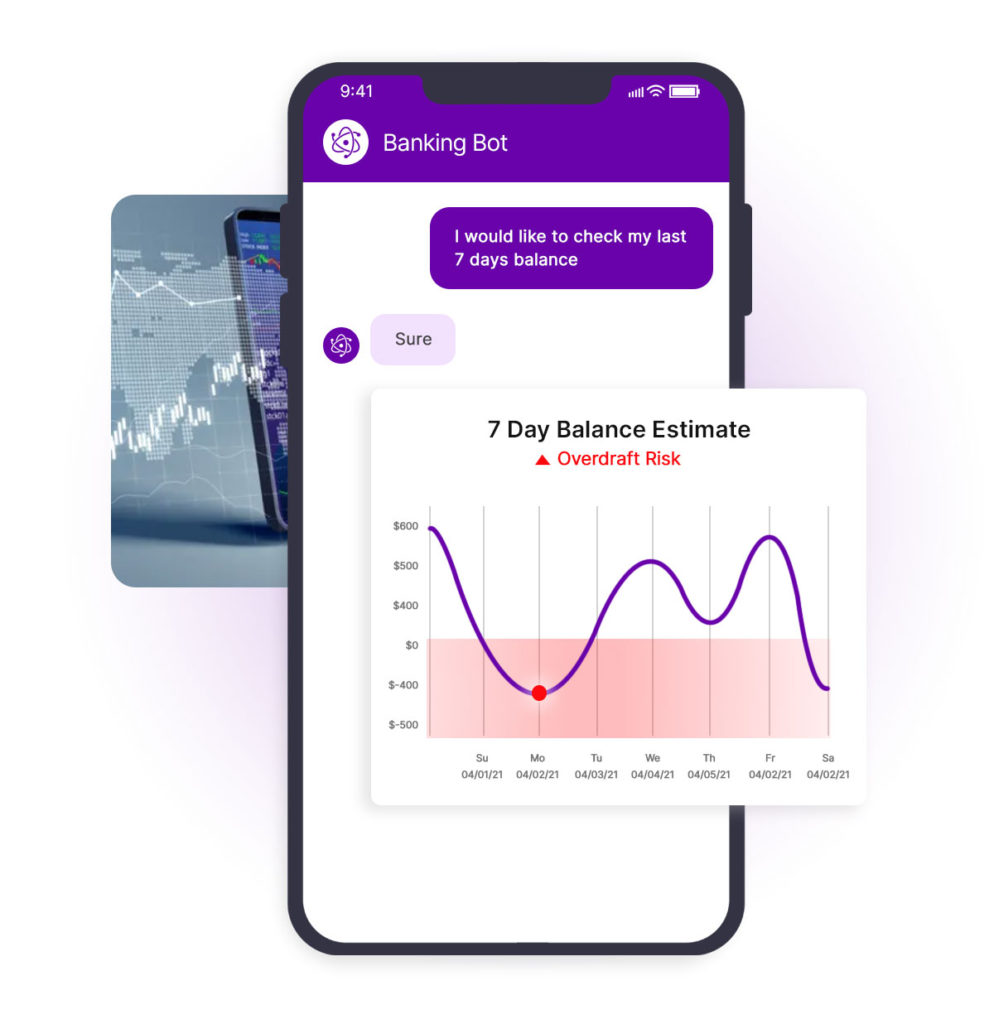

Quick Information About Customer Finances and Advice

Banking Bots not only provide all sorts of financial information but also are capable of keeping this information safe. Bots provide this information with much contextual context and insights for greater knowledge. We now embrace conversational banking with this and consider chatbots as new-age banking executives. Banking Bots can quickly extract customer information from the available banking database.

Automated Customer Service

With conversational AI, banks can enjoy the benefits of customer using self servicing driven by the banking bot. Banking chatbots understand the intent of the customer and provide customers with self-service channels. Conversational AI Chatbots can easily identify the friction points within the customers’ banking journey and seamlessly optimize their experiences with the existing banking system. Additionally, this also helps banks cut down on expenses related to adding more executives to cater to customer needs.

Easy KYC Initiation

Customers do not need to refill a detailed form whenever they visit a bank. Bots will enable easy and simple transactions with just a couple of clicks on finger impressions to make sure that these transactions are safe and secure.

Conclusion

Banking chatbots aren’t just providing good customer service but are improving the way customers interact with banks and engage with customers . Banking Chatbots are revolutionizing the way banks provide their services to customers. Banking officials want to collaborate more with AI specialists to make sure great service for their customers. After all, it’s about faith and trust when it involves your money. And banks want to enhance the overall experience of how you manage and invest your money.

Want to find out more about bots for banks? Please be in-tuned or send us a message. We’ll get you started.

To know more visit: appsai.com.au!