Nowadays, our bankers understand the importance of technology incorporated into their day-to-day processes. And, that is why Banks are no longer shying away from adopting modern technology for general business success. And, one of those technologies that Banks can greatly benefit from, is Artificial Intelligence and Machine Learning, wrapped into a product called conversational AI Chatbots.

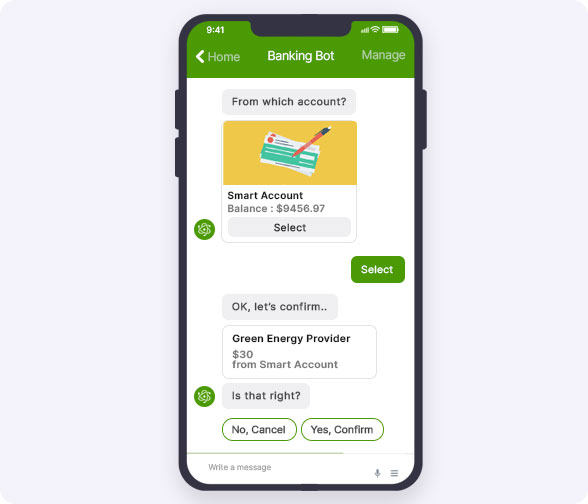

Conversational AI Chatbots within the banking system can help make everyday banking tasks easier. The main purpose of banking chatbots is to provide better customer experience. Chatbots in banking can help combine technology with a human touch to make banking tasks a lot easier. Chatbots are AI-enabled conversational interfaces. Chatbots can manage smart and compelling communications. They promise to reinforce the bank’s clients’ experience and their reach.

As a matter of fact online banking has increased in popularity and it’s no secret that now banks are being held to higher standards than before when it involves creating a positive digital customer experience. Customers want faster service across all devices. Chatbots in banking is one of the solutions that is going to assist banks to compete with emerging industries. Banks and other financial services provider companies should specialize in offering efficient customer service on their customers’ digital channels of choice.

Banks are using AI-powered bots to serve customers promptly and efficiently, therefore changing the landscape of customer experience. And, if you are curious enough, here are a few ways to use chatbots can be used to automate day-to-day tasks in the banking industry:

Update account information: Let customers interact with the bot and update their personal information themselves instead of customers chatting with an agent.

Answer Mastercard or banking product questions: From sign-up to card selection details, banking query resolution is done in minutes with the help of a conversational bot.

Get account balances: Allow customers to seek out their banking account balances quickly through a conversational interface.

Find branches or ATMs: Chatbots can help customers find the nearest branch or ATM.

Intricate Account Details: Hard-to-find account details like SWIFT & IFSC code, or IBAN Number can easily be tracked with one single message from the customer.

Block Credit/Debit Cards: Blocking cards or reporting transactions can easily be done via the comfort of your home without having to visit the branch.

Conclusion

The banking system is ripe with possibilities when it involves the adoption of chatbots to help customers. There are many scenarios during which you’ll use chatbots in banking services that can benefit both you and your customers.

Try a banking chatbot for your customers to provide better banking services and deliver a high-quality customer experience. Or, if you’re keen on creating a customized bot of your own, send us a message or visit our website: appsai.com.au and we’ll get you started.