Bring Innovation To Insurance With Insurance Chatbot

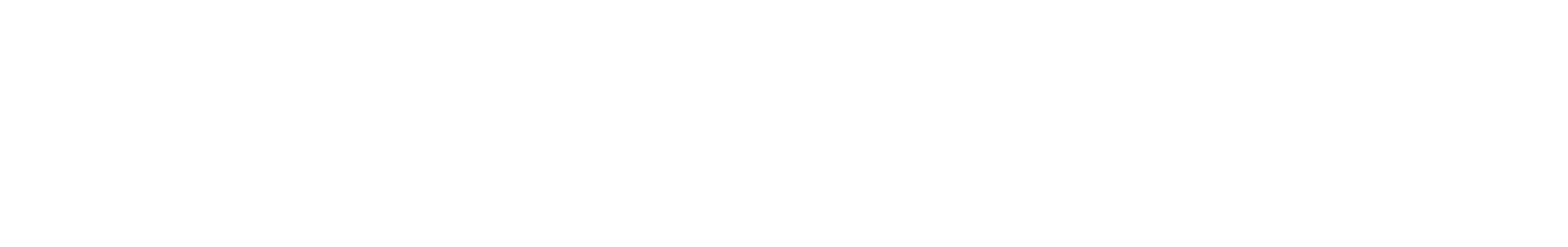

Ease the complexity of day-to-day insurance processes by eradicating the need to fill hand written forms, detailed questionnaires, tedious background checks, and so much more. With the power of artificial intelligence create adaptive finance chatbot models with natural language processing to have insightful and engaging conversations with the prospective customers.

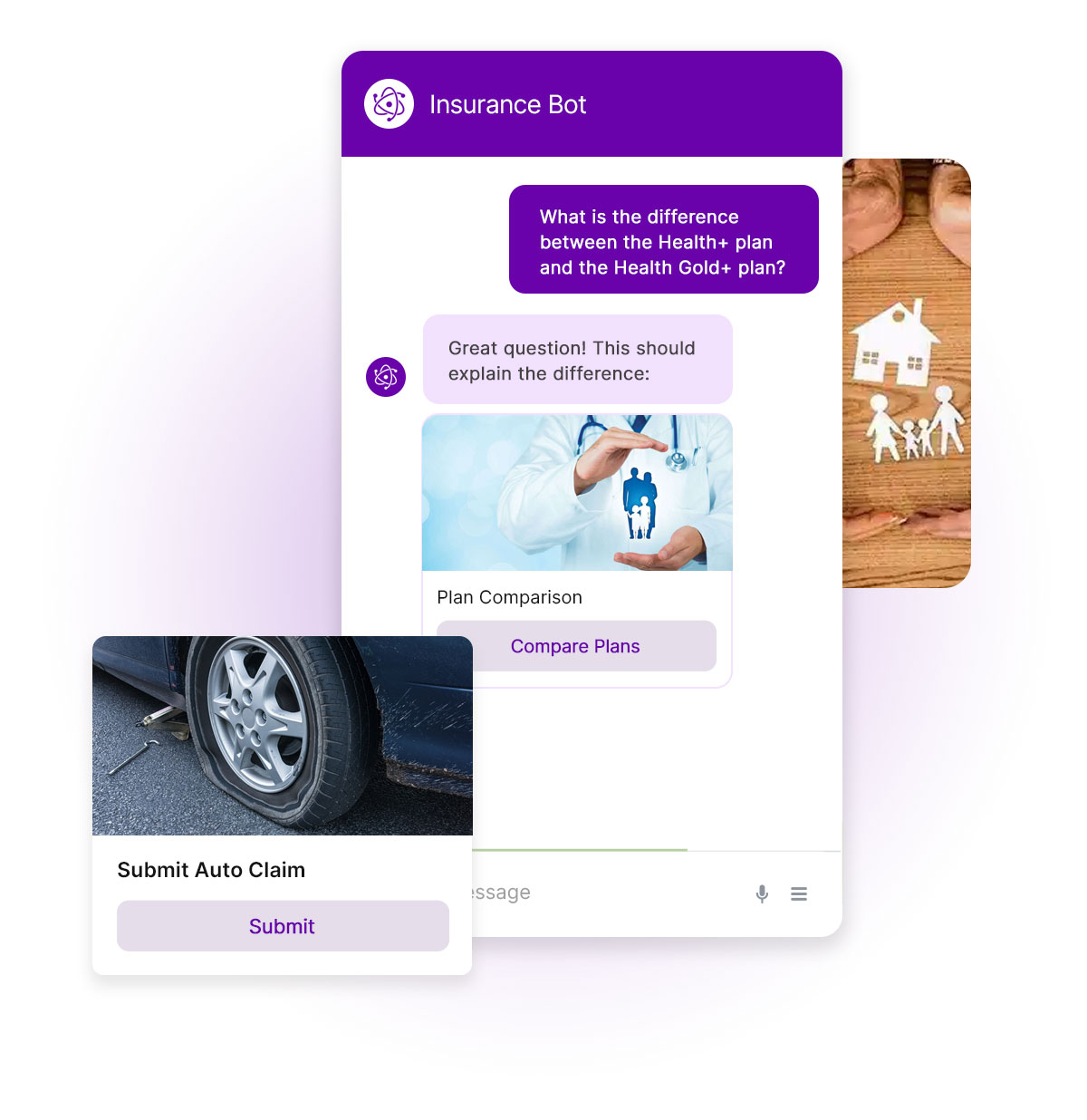

Finance chatbots are adding real time value to the insurance industry by turning into the customer facing agent that is quicker, more efficient, and digitized than ever before. And, as a matter of fact, unlike Insurance chatbots that are available round-the-clock, no insurance agent is available outside their normal working hours. And, the best part without having the customer to pick up the phone and customers can interact using their favourite messaging channels like Facebook and Whatsapp.

Minimized Response And Handling Times

According to a survey conducted by Statista in 2019, 44% of the customers found using chatbots for insurance claims as convenient. And, interestingly, 43% of them were ready to use insurance chatbots to buy insurance policies.

Insurance bots can easily collect information about prospect’s finances and other relevant data required to avail insurance solutions. Moreover, you can use insurance bot and leveraging machine learning, the virtual agent can predict the insurance policy the client is highly likely to purchase.

Seamless and Efficient Customer Onboarding

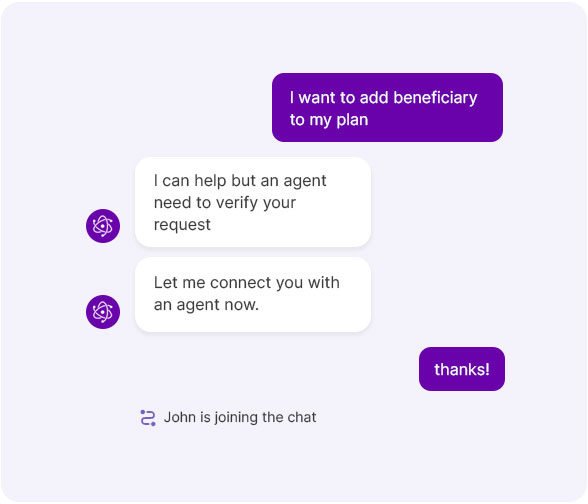

Onboarding new customers is an essential part of an insurance agent’s acquisition strategy. But, onboarding an insurance customer is not a piece of cake, the insurance customer’s journey is quite complicated. It includes an intensive congregation of customer’s data, along with a mandate to verify the provided information.

Now onboarding customers is super swift and effortless with an insurance chatbot that convinces and engages customers by offering the policy of choice. Your prospects get to experience the essence of Conversational AI Insurance along varied messaging channels.

- Increased customer awareness in terms of policy knowledge

- Proactive lead generation and customer engagement

- Hassle free claim processing and payment assistance

- Extended hours for insurance customer support

Scale Insurance Customer Support In No Time

With AppsAI’s insurance bots, automate at least 60% of your daily inbound website traffic and answer routine customer queries effectively. Any insurance customer that tries to reach you for services via email, phone, or other communication platform, is already seeking a digitized experience. Waiting for a revert from your end, no more meets the needs of your smart customer these days. Investing in an insurance bot could save a lot of your customer’s time and save you a significant amount of money maintaining your team of agents.

Using insurance chatbots, educate more prospects on the benefits of an insurance policy, recommend the right one for them, and increase visibility and engagement within the prospect pool. Scaling up and gathering leads is super easy with conversational AI insurance bots available at your disposal 24 hours a day. With reduced operational costs and improved customer experience, AI powered chatbots are going to revolutionize the way the insurance industry works.

Skyrocket Sales Conversions With Finance Chatbots

From convincing and converting customers to enabling them to renew the policy, the routine journey of an insurance agent is tedious. But, the complexities of the journey can simply be eliminated by introducing insurance bots into the entire journey of user onboarding and retention. This way users can experience frictionless onboarding while making informed decisions based on wide availability of FAQs stored in the AI Bot’s knowledge base. And, a more personalized customer experience would lead to higher retention and conversion rates. Let users ask the questions and compare the competitive pricing, choose the right policies using the intelligence and quick response rates of the virtual AI insurance chatbot.